Taxation of bonds in trust

12 February 2025

Key points

- Bonds in trust do not follow the normal trust taxation rules

- The 45% trust rate will only apply if the settlor is dead or non-UK resident

- The settlor can reclaim any tax they are liable for from the trustees

- Assigning to a beneficiary can avoid tax at the trust or settlor’s rates of tax

- Gains on absolute trusts are generally looked through and taxed upon the beneficiary

Jump to the following sections of this guide:

Who is assessable on bond gains within a trust?

Investment bonds held in trust don’t follow the usual trust taxation rules. The chargeable event rules determine who is assessable on any gains. This will typically be the settlor of the trust during their lifetime. However, the trustees may be liable if the settlor is deceased or is not UK resident in the year of assessment.

These special rules don’t apply to absolute trusts where the trust is generally looked through and the gains assessed on the beneficiaries.

Of course, other trusts may have the option of assigning the bond or segments of it to a beneficiary rather than pay cash to them. This doesn’t create a chargeable event. And all future gains will be taxed upon the beneficiary.

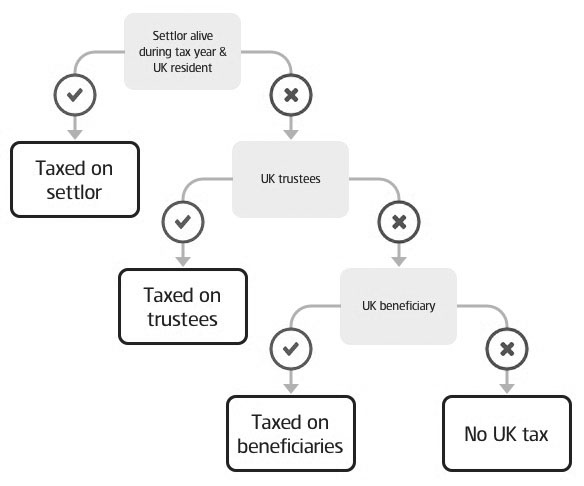

Liability for any tax will depend upon whether the settlor is still alive and UK resident in the tax year of assessment. The diagram outlines who is assessable for gains arising within the trust (excluding absolute trusts).

Gains during the settlor’s lifetime

The settlor will be assessed on chargeable gains if alive and UK resident at the time of the chargeable event. The gain and tax liability will be calculated as if the settlor owned the bond and normal top slicing rules will apply. Additionally, the settlor remains assessable throughout the tax year of their death. For example, if the trustees surrender the bond after the settlor's death but in the same tax year, the executors will enter any taxable gain on the deceased individual’s self-assessment tax return. The tax payable will depend on whether the investment bond is onshore or offshore.

On a joint settlor trust where the first settlor died in a previous tax year, only a share of the gain for the last settlor to die can be assessed on them in the tax year of death (as above), the remaining half will be taxed at the trust rate with no top slicing relief.

The settlor (or executors, where the chargeable event occurs in the tax year of death) has the right to reclaim any tax payable from the trustees. Failure to reclaim the tax will mean the value remains within the settlor's estate for IHT. If the settlor doesn't wish to reclaim the tax, they should notify the trustees of their intentions. This may be a transfer of value for IHT purposes unless it's covered by an available exemption.

Gains after the settlor’s death

Trustees will be taxed on chargeable gains that arise:

- after the tax year of the settlor's death (unless the 'dead settlor' rules apply), or

- when the settlor is non UK resident.

If the settlor is dead and the bond is being cashed in a tax year after their death, the full gain will be taxed at the trustee rate of tax (currently 45%).

If the bond is onshore, the trustees will also receive a credit of 20% against their liability meaning they will have a further 25% to pay on the gains made.

From 6 April 2024 the £1,000 standard rate band was abolished. Trustees will have no tax to pay on gains less than *£500. If the gain is more than £500 it will be taxed at the trustee rate of 45% (25% for onshore bonds).

*If the settlor has created other trusts, the amount available is the higher of £100 or £500 divided by the total number of existing trusts.

Trustees cannot use top slicing or time apportionment relief to reduce the tax payable on the gain.

There may be some older cases where the gain escapes tax completely. This applies where the trust and bond were set up and the settlor died before 17 March 1998. This was known as the ‘dead settlor’ rule.

Joint settlors

Where there is more than one settlor, each will be assessed separately on their share of the gain.

- If an existing bond was assigned into the trust, each settlor will be deemed to have an equal share. This is because it is the rights to the policy that are transferred to the trust and each joint owner has equal rights to the proceeds.

- If each settlor added cash to the trust and the bond was purchased by the trustees, gains will be assessed proportionately based on their contribution to the trust.

If there is only one surviving settlor, a gain may be apportioned between the surviving settlor at their marginal rates and the trustees at 45%.

Gains taxable upon the beneficiary

It is often preferable for gains to be assessed upon the beneficiary(ies) as they may pay tax at a lower rate than the trustees or settlor. And if there is more than one beneficiary there may be more allowances and tax bands available to spread the liability.

Assigning to beneficiaries

Assigning the bond to a beneficiary (who is an adult) allows the bond to be cashed in at the beneficiaries’ tax rate. Once the bond (or segments of the bond) is assigned, the beneficiaries are treated as if they have always owned it and top slicing relief for the entire period is available to them.

Deed of Apppointment

Alternatively it may be possible to appoint benefits absolutely, if assignment is not possible (for example, where the beneficiaries are minors). This is normally done by using a deed so that the bond (or part of it) is held on a bare trust. Unlike an assignment, the trustees will still own the bond but the gains will be taxed at the beneficiaries’ rates in the same way as an absolute trust (see below). This will not work if the parent set up the trust as the parental settlement rules will apply.

Where bonds are assigned from a discretionary or flexible trust to a beneficiary or where a deed of appointment creates a bare trust this will be a capital distribution from the trust - triggering an IHT exit charge. Typically this will only be the case if there was an IHT charge when the trust was set up, or at the previous 10 year anniversary.

Absolute trusts

Absolute (bare) trusts are generally looked through with chargeable gains assessable upon the beneficiary.

The beneficiaries will be taxed in the same way as an individual who owns an investment bond outright. The tax payable will depend on whether the investment bond is onshore or offshore, and the beneficiary’s rate of tax.

Where there is more than one beneficiary, each will be assessed proportionately on any bond gain based on their share of the trust fund.

Parental settlements

If an absolute trust has been set up by parents for the benefit of their minor children, any gains are likely to be taxed on the parents. Only gains below a £100 limit each tax year would be taxed as the child’s income. If the gain is more than £100, the whole gain is taxed as the parent’s income. If there are joint settlors, this £100 limit is doubled. The limit is also for each child beneficiary of the trust.

Non-UK trusts

Beneficiaries may be liable if they receive a payment from a non-UK resident trust. If the settlor is deceased or non-UK resident and there are no UK resident trustees, it's the UK beneficiaries who will be liable but only to the extent that they actually benefit under the trust from the gain. But there will be no top slicing relief available.

Reporting taxable gains from investment bonds in trust

Where an individual is responsible for reporting gains, they should enter these on their self-assessment return.

If the trustees are liable to tax on the gain they should complete a self-assessment form. The trust must have previously registered with HMRC by 5 October of the tax year following the year of the assessment. However, absolute trusts are not required to register as the beneficiary is liable for the tax.

| Help | Trust and Estate Tax Return guide and HMRC Help Sheet 320. | Trust and Estate Foreign notes and HMRC Help Sheet 321. |

| Trustees | ||

| Bonds | Onshore | Offshore |

|

Gains |

Trust and Estate Tax Return (SA900) .Enter the tax treated as paid and the chargeable gain in boxes 9.15 and 9.16 respectively. |

Trust and Estate Foreign (SA904). Enter the chargeable gain in box 4.6. |

Issued by a member of the Aberdeen Group, which comprises the Aberdeen Group plc and its subsidiaries.

Any links to websites, other than those belonging to the Aberdeen Group, are provided for general information purposes only. We accept no responsibility for the content of these websites, nor do we guarantee their availability.

Any reference to legislation and tax is based on Aberdeen's understanding of United Kingdom law and HM Revenue & Customs practice at the date of production. These may be subject to change in the future. Tax rates and reliefs may be altered. The value of tax reliefs to the investor depends on their financial circumstances. No guarantees are given regarding the effectiveness of any arrangements entered into on the basis of these comments.

This website describes products and services provided by subsidiaries of the Aberdeen Group.

Full product and service provider details are described on the legal information.

Aberdeen Group plc is registered in Scotland (SC286832) at 1 George Street, Edinburgh, EH2 2LL

Standard Life Savings Limited is registered in Scotland (SC180203) at 1 George Street, Edinburgh, EH2 2LL.

Standard Life Savings Limited is authorised and regulated by the Financial Conduct Authority.

© 2025 Aberdeen Group plc. All rights reserved.