Bypass trusts

29 August 2024

Key points

- A bypass trust is a generic term for a trust created to receive pension lump sum death benefits

- Pension lump sums paid to a bypass trust will suffer a 45% tax charge if the pension scheme member dies after age 75

- Payments to a beneficiary will be treated as income if it comes from the pension lump sum which had 45% tax deducted, with credit given for the tax already paid

- The anniversary for IHT periodic charges may be linked to the date the member joined a trust based pension scheme

- There may be more than one IHT nil rate band for periodic and exit charges when pension funds have been consolidated

Jump to the following sections of this guide:

What is a bypass trust?

'Bypass trust' is a generic term used to describe a trust which is set up to receive pension lump sum death benefits. The name originates from the fact the pension death benefits are paid to the trust rather than to the surviving spouse and therefore the funds bypass the spouse's estate for IHT.

Who might use one?

Since pension freedoms and the changes to pension death benefits, the main reason why someone might use a bypass trust has been to allow greater control and flexibility over how funds are eventually paid out.

A bypass trust is an effective way of maintaining an element of control over the payment of pension death benefits after the death of the member. It's the trustees of the bypass trust who decide who will benefit and when. And it's the member that chooses and appoints their own trustees for the bypass trust. A trustee chosen by the scheme member is likely to be closer to the scheme member and have a better understanding of their wishes.

In particular, a bypass trust can be especially useful for:

- complicated family situations - such as where there are children from a previous relationship. The bypass trust would allow the trustees to appoint capital or income to the surviving spouse during their lifetime ensuring that they are provided for, but following the spouse's death all the remaining capital could be distributed to the settlor's own children.

This level of control would not be possible if the surviving spouse received a lump sum or beneficiary's drawdown because the surviving spouse would decide who would benefit after their death. Instead of paying the death benefits to the member's children, the spouse could arrange for any remaining funds to be paid to their own children, or even to a new spouse or partner if they have remarried or are in a new relationship - young or vulnerable beneficiaries - the trustees, often with guidance from an expression of wish completed by the scheme member, will decide how and when the beneficiaries will benefit from the trust fund - for example, the trustees might want to delay paying capital or income to the beneficiary until they have a certain level of maturity, say age 25

- making one off or ad-hoc payments to a range of beneficiaries

- making loans to a beneficiary - for example, the trustees may prefer to grant loans to the spouse rather than make outright payments. Any outstanding loan on the spouse's death may be allowable debt on their estate if it's repaid to the trustees

This additional control and flexibility can however come at a cost. Individuals considering a bypass trust would need to balance these advantages against the potential tax charges that would apply to a lump sum paid to the bypass trust as well as the cost of ongoing trust taxation and administration. For many, nominating a spouse, children or friends to receive beneficiary's drawdown pension could be a simpler and more tax efficient solution.

Establishing the trust

The trust is typically a discretionary trust which the pension scheme member sets up during their lifetime. It's often established with a nominal amount, such as a £10 note or a first class stamp, so that in the event that the trust is not needed, large amounts of money aren't unnecessarily held upon trust.

Once set up, the trust effectively lies dormant until the pension scheme member dies and their lump death benefits are paid into it.

It's also possible to create a trust in the pension scheme member's will and have pension lump sum death benefits paid into it.

Paying the lump sum into the trust

The pension scheme trustees/administrator will normally have discretion over where death benefits are paid. The scheme member can complete a nomination form to help guide the trustees in their decision making and to highlight that they would like them to pay a lump sum to the trust they have created.

Some pension schemes allow the member to make a binding nomination to their bypass trust. This gives them certainty that the death benefits will be paid to the trust that they've created. Provided the bypass trust does not allow payment to the member, or their estate, this will not impact the IHT effectiveness of the arrangement.

Nominations (including most binding ones) can be revoked at any time. Simply completing a fresh nomination is sufficient and the pension scheme trustees will consider the most recent instructions they receive.

Tax on the bypass trust while settlor is alive

Typically the initial transfer into the trust is for a nominal amount - this is just to establish the trust. This will usually be covered by the £3,000 annual exemption and therefore it's not a chargeable lifetime transfer (CLT).

If the initial amount is not covered by any exemption, it will be a CLT. There will be a 20% tax charge on creation if the amount transferred into trust, when added to other CLTs in the preceding seven years, exceeds the IHT nil rate band. However, unless the scheme member chose to add more than a nominal amount to the bypass trust, any CLT IHT charge would be very small.

The trust will be subject to 10 yearly periodic and exit charges. However, if only a nominal amount is held there will be no tax to pay or reporting required.

Holding just a nominal amount in the trust means that there is unlikely to be any income tax or CGT for the trustees to report or pay tax upon.

Tax when the lump sum is paid into the trust

Death before age 75

If the member died before age 75 any lump sum death benefits paid to trust will be tax free provided the member had sufficient lump sum and death benefit allowance (LSDBA) available.

Any lump sum death benefit in excess of the LSDBA will be taxed as income of the trust. This will mean the trustees of discretionary bypass trusts will need to pay a 45% tax charge on the lump sum received in excess of the LSDBA.

Lump sum death benefits paid to trust more than two years after the member died will be subject to a 45% Special Lump Sum Death Charge. This is applied to the whole lump sum, not just the excess over the LSDBA, and will be deducted by the scheme administrator.

Death after reaching age 75

If the member died after reaching age 75, the scheme administrator must deduct the Special Lump Sum Death Benefit Charge of 45% from the whole of the lump sum before it is paid to the trust.

Example

Judy died age 80 and had nominated that on her death any remaining funds in her SIPP should be paid into her bypass trust. The SIPP was valued at £200,000.

- The SIPP provider must deduct £90,000 and pay this directly to HMRC

- The balance of £110,000 is paid to the bypass trust

There's no immediate IHT charge when the pension death benefits are paid to the bypass trust.

Tax on the trustees

The trustees will be responsible for any income tax and capital gains which arise from investment within the trust. There may also be IHT periodic and exit charges on the trust.

Income and capital gains

Once the lump sum is paid to the bypass trust, it losses the protection from income tax and capital gains that it enjoyed whilst in the pension. Normal trust rules will apply to future income and gains.

If it's a discretionary trust this will mean that:

- Income tax is payable at 45% (39.35% dividends). From 6 April 2024 the £1,000 standard rate band has been abolished. Trusts with total income of less than £500 will pay no income tax. There is no dividend allowance for the trustees of a discretionary trust.

- Capital gains will be taxed at 20% (24% on residential property) with half the annual CGT allowance

- Both the £500 low income exemption and trust CGT annual exempt amount will be shared if the settlor created any other trusts.

Income tax paid by the trustees will form part of the trust 'tax pool'. This is used to provide a tax credit when income is paid to a beneficiary.

Trust inheritance tax

Once the lump is paid into the bypass trust, it becomes relevant property. The funds within the trust are subject to 10 yearly periodic charges and exit charges when capital is paid out.

The settlor's previous pension scheme(s) will determine when the periodic charge applies and also how the charge is calculated.

Trust based pensions

Where the lump sum is paid from a trust based pension, it's treated for IHT as if it's still within that trust when calculating periodic and exit charges. The anniversary date for any periodic charge calculation is taken to be the date the member joined the pension scheme (or earlier pension scheme if there had been a previous transfer).

This is because anti-avoidance rules, prevent someone from moving money from trust to trust to avoid payment of the periodic charge. But as the funds transferred into the bypass trust property haven't always been relevant property - i.e. the fund wasn't relevant property while in a pension scheme - any charge will be reduced to reflect the time that it was relevant property.

Example

Portia set up a trust based SIPP on 5 March 2014 with a single contribution of £50,000, which she topped-up regularly over the years. When she died on 1 February 2022, her SIPP paid a lump sum death benefit of £500,000 to a bypass trust.

The first periodic charge under the bypass trust fell due on 5 March 2024 (the 10th anniversary of the first SIPP contribution), when the trust fund was worth £550,000. It's calculated as follows:

| Deemed transfer of value | £550,000* - £325,000** (NRB) = £225,000 |

| Notional tax payable | £225,000 x 6% = £13,500 |

| Effective rate for periodic charge | £13,500/£550,000 x 100 = 2.45% |

| Relief for period when not relevant property (in complete quarters) | 31/40 (i.e., 5 March 2014 to 1 February 2022 = 31 quarters) |

| Tax due by trustees | (9/40) x £550,000 x 2.45% = £3,032 |

* Value of trust fund at 10 yearly anniversary.

** Available NRB at 10 yearly anniversary.

Contract based pensions

Contract based pensions are not treated as settlements for IHT. This includes pensions such as RACs, Section 32s and many personal pensions which are established by deed poll or board resolution rather than a trust deed. They only become settlements if they're paid to a trust, or transferred into a trust based pension. In these circumstances, they're treated as an addition to that trust - they don't create a separate settlement with its own nil rate band and 10 year anniversary date.

Example

Derek transferred an old Section 32 (contract based) to a SIPP (trust based) to allow drawdown in retirement. He also nominated a bypass trust to receive the lump sum death benefits payable from his SIPP.

The transfer of the S32 to the SIPP is treated as an addition to the SIPP for IHT purposes. If Derek dies and the death benefits are paid into the bypass trust, the periodic charge date will be based on the date that Derek became a member of the SIPP and not when he took out the Section 32.

Consolidation and the number of settlements

The tax position becomes more complicated where the deceased had a number of pensions and either:

- consolidated them into one pension, or

- arranged for the lump sum death benefits to be paid to one trust

Again anti-avoidance rules apply when a pension is transferred from one trust based pension to another. So where a lump sum is paid to a bypass trust, this can mean that the trust is treated as a number of separate settlements for IHT - each with its own 10 year anniversary and IHT nil rate band for periodic and exit charges.

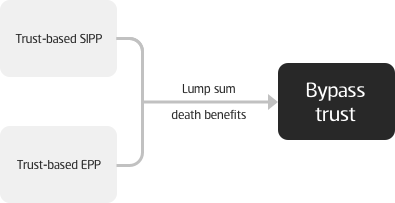

Scenario 1: Payments to a bypass trust from more than one pension scheme

Both the SIPP and EPP pension schemes (trust based) are settlements for IHT, so in this scenario:

- the lump sum death benefits from the SIPP and EPP create two separate settlements under the bypass trust, each with its own nil rate band

- the bypass trust will also have its own nil rate band to use against any other assets excluding the death benefits. Often this will just be the initial starter gift to create the trust

- periodic charges for each settlement will fall due on each 10th anniversary of the date the deceased joined the relevant pension schemes

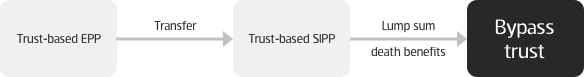

Scenario 2: Payment to a bypass trust from a consolidated pension scheme

In this scenario:

- because the SIPP was simply a consolidation vehicle for the EPP transfer, and no contributions were paid to it, the lump sum death benefit only creates one settlement, and therefore one nil rate band, for IHT under the bypass trust. The settlement will be deemed to have started when the member joined the original EPP

- again, the bypass trust will also have its own nil rate band to use against any other assets excluding the death benefits

- after death, periodic charges will fall due on each 10th anniversary of the date the deceased joined the EPP

But if the SIPP had received contributions as well as the EPP transfer, the position would be:

- the lump sum death benefit would create two separate settlements under the bypass trust (one for the funds originating from the EPP and another for the funds originating from the SIPP contributions), each with its own nil rate band

- periodic charges for the 'EPP settlement' will fall due on each 10th anniversary of the date the deceased joined the EPP

- periodic charges for the 'SIPP settlement' will fall due on each 10th anniversary of the date contributions were first paid to the SIPP

Where multiple trust based pensions have been consolidated into a single trust based scheme, it will mean that there are multiple nil rate bands available to limit the impact of future periodic and exit charges. In these circumstances, the anti-avoidance rules actually achieve a better outcome for the trust beneficiaries.

However, the rules do prevent someone setting up multiple bypass trusts to receive death benefits from a single trust based pension with the intention that each might have its own nil rate band. Here the available nil rate bands would be shared across each bypass trust.

Example

Gloria transferred her DB pension into a trust based SIPP. She continued to make contributions to the SIPP until her retirement. When she died she nominated that the death benefits were to be paid to four bypass trusts that she had created.

There will be two settlements for IHT following the payment of the death benefits:

- for the DB benefits which were transferred to her SIPP

- for the contributions made to the SIPP

In these circumstances, 25% of the value from each of these settlements will be paid into each bypass trust. The nil rate bands for each of these settlements will be shared equally across the four bypass trusts so that each bypass trust benefits from half a nil rate band, i.e. a quarter from the DB Pension and a quarter from the SIPP.

Apportioning the value between settlements

Where a bypass trust contains multiple settlements created by lump sum death benefits originating from different pension schemes, it's not usually possible to identify what property specifically belongs to each settlement. In these circumstances, HMRC are likely to accept a simple pro rata exercise to determine the value of each settlement to calculate periodic or exit charges.

For example, suppose a bypass trust received lump sum death benefits of £200,000 from an EPP and £100,000 from a SIPP. The value of the individual settlements for the purpose of calculating periodic or exit charges can be taken as the proportionate share of the total trust value at the relevant dates. So:

- the 'EPP settlement' can be valued as 2/3 (i.e., £200,000/£300,000) of the total

- the 'SIPP settlement' can be valued as 1/3 (i.e., £100,000/£300,000) of the total

Example

James had two pensions that paid lump sums to the same bypass trust when he died on 1 August 2018:

- a trust based EPP set up on 1 February 1986, which paid £200,000 to the bypass trust

- a trust based SIPP set up on 1 May 2003, which paid £100,000 to the bypass trust

When the first 10 yearly charge takes place on 1 May 2023 in relation to the 'SIPP settlement' (the 10th anniversary of the first SIPP contribution), the total trust fund is worth £600,000. The value of the SIPP settlement is taken as £200,000 (that is, £600,000 x £100,000/ £300,000). This is within the nil rate band at the 10 yearly anniversary date, as James had made no previous chargeable transfers. Therefore, even although the total trust fund is worth more than the nil rate band, there is no periodic charge.

When the second 10 yearly charge occurs on 1 February 2026 in relation to the 'EPP settlement' (the next 10th anniversary of the first EPP contribution after James' death), the total trust fund is worth £720,000. The value of the EPP settlement is taken as £480,000 (that is, £720,000 x £200,000/ £300,000). In this case, there will be a periodic charge on the excess over the nil rate band under the 'EPP settlement'.

| Deemed value of second settlement | [£200,000/(£100,000 + £200,000)] x £720,000 = £480,000 |

| Deemed transfer of value | £480,000 - £325,000* (NRB) = £155,000 |

| Notional tax payable | £155,000 x 6% = £9,300 |

| Effective rate for periodic charge | £9,300/480,000 x 100 = 1.94% |

| Relief for period before the property became relevant property (in complete quarters) | 10/40 (i.e., 1 February 2016 to 1 August 2018 = 10 quarters) |

| Tax due by trustees | (30/40) x £480,000 x 1.94% = £6,984 |

* Nil rate band at the 10 yearly anniversary date.

The availability of the additional nil rate band has resulted in significant tax savings.

Tax on payments to the beneficiaries

The tax payable on distributions to a beneficiary from a 'discretionary' bypass trust will depend upon whether it's a payment of income or capital. Regardless of the scheme member's age at the date of death, all income payments are subject to income tax.

Capital payments originating from a death benefit lump sum where the scheme administrator deducted the 45% Special Lump Sum Death Charge (i.e. where the member died after age 75 or the lump sum was paid more than two years after death) will also be treated as income in the hands of the beneficiary. But such payments will also be regarded as an exit from a relevant property trust and could attract an IHT charge.

The payment of any other capital from a bypass trust (e.g. growth on investments or capitalised trust income) could also be subject to an IHT charge as an exit.

Finally, if the trustees need to sell any of the trust assets to provide cash to the beneficiary, there could be tax payable by the trustees. And if the trustees choose to distribute capital by assigning a bond to a beneficiary, there could be tax payable when the beneficiary surrenders the bond.

Income tax

Payments of trust income to a beneficiary

Once the lump sum has been invested, any income received by the trustees will be taxable under normal discretionary trust taxation rules. Income received by a discretionary trust will be taxed at 45% (39.35% for dividends). This tax paid will form part of a tax pool available to the trustees when making income payments to a beneficiary.

When trustees pay income to a beneficiary it's treated as trust income and must paid with a 45% tax credit. The trustees must have sufficient credit within the tax pool in order to distribute the income.

Pre 75 deaths

Where the scheme member died before age 75, the lump sum death benefit within the LSDBA is paid to a bypass trust tax free. Normal discretionary trust taxation rules will apply, which means that any future payments of capital to the beneficiary are not subject to income tax.

Lump sums paid to a bypass trust in excess of the LSDBA are taxed as income. The trustees will need to pay tax at 45% on this excess. The tax paid by the trustees will form part of the tax pool for trust income. This will be available to pay as a tax credit with future income distributions to the beneficiaries but not for capital payments.

Post 75 deaths

Where a scheme member died after age reaching 75, the lump sum death benefit will have had the 45% Special Lump Sum Death benefit charge deducted by the scheme administrator when it was paid to the bypass trust.

Any payments of capital from the bypass trust to the beneficiary are subject to special tax treatment. When funds which originate from pension death benefits subject to the Special Lump Sum Death Benefit charge are paid to a beneficiary of the bypass trust, they're treated as income for tax purposes. The 45% tax charge deducted by the scheme administrator forms part of a tax pool (separate from the tax pool for trust income) and this is available as a credit to the beneficiary when they receive a payment.

What the beneficiary receives is a payment which will be grossed up by 45% to reflect the tax already deducted. This tax credit is available to offset against the beneficiary's tax liability and they can make a reclaim from HMRC for any overpaid tax.

Example

Joan nominated that her SIPP should be paid to her bypass trust on death. She died at age 80 and her SIPP was valued at £200,000.

The lump sum death benefit will be subject to tax at 45% - i.e. £90,000. This will be deducted by the pension provider and the amount paid to her bypass trust will be £110,000. The trustees will only have £110,000 to invest for the beneficiaries.

Joan's trustees decide to make a payment out of the trust to her son Steve. The trustees pay £5,500 to Steve. This is grossed up to £10,000 to reflect the 45% tax already paid.

Steve has other income of £30,000 for the year. The £10,000 payment from the trustees will be taxed at 20% = £2,000. As it was paid with £4,500 tax credit, Steve can reclaim £2,500 from HMRC.

This special tax treatment ends once all the original lump sum death benefits have been distributed. All future payments will then be treated as a normal capital payment or a distribution of income earned by trust investments..

This is intended to bring the tax treatment of post 75 death benefits in a bypass trust on a broadly equal footing to pension benefits remaining in a pension as beneficiary's drawdown. However, the trustees will only have the net amount after tax to invest and this will severely affect the future investment growth potential of the bypass trust funds compared to that available as beneficiary's drawdown.

This special treatment is not extended to pre 75 lump sum death benefits in excess of the LSDBA..

Inheritance tax

When capital leaves a bypass trust and is paid to a beneficiary, an IHT exit charge could be payable. An IHT exit charge could be payable even if capital is paid out before the first 10 yearly anniversary within the bypass trust has been reached.

Exit charge before the first 10 yearly anniversary

Any exit charges that arises before there has been a 10 yearly anniversary within the bypass trust are based on the value of the death benefits transferred into the bypass trust (this is the date that the death benefits became relevant property) and the NRB at the date of the exit. Any charge is then adjusted to take into account the period of time that the bypass trust has held relevant property.

Example

Tessa died on 1 September 2020 and £500,000 was paid into her bypass trust. The next 10 year anniversary date is 1 January 2025 (taken from the date she joined the scheme).

On 1 September 2022, the trustees paid £100,000 to Tessa's daughter.

| Deemed transfer of value when assets became relevant property | £500,000* - £325,00** (NRB) = £175,000 |

| Notional tax payable | £175,000 x 6% = £10,500 |

| Effective rate of tax | (£10,500/£500,000) x 100 = 2.1% |

| Period of time assets were relevant property | 8 complete quarters (1 September 2020 to 1 September 2022) out 40 |

| Tax due by trustees | (8/40) x 2.1% x £100,000 = £420 |

* Value of death benefits transferred into the bypass trust.

** Available NRB at the date of exit.

Exit charge after the first 10 yearly anniversary

Any exit charges that arise after a 10 yearly anniversary are based on the value of the trust fund at the last 10 yearly anniversary and the NRB at the date of the exit.

Example

Henry died on 1 June 2016 and pension death benefits were paid into a bypass trust. The value of his trust fund at the last 10 yearly anniversary (1 February 2021) was £550,000.

On 1 March 2024 the trustees paid £100,000 to Henry's son.

| Deemed transfer of value when assets became relevant property | £550,000* - £325,000** (NRB) = £225,000 |

| Notional tax payable | £225,000 x 6% = £13,500 |

| Effective rate of tax | (£13,500/£550,000) x 100 = 2.45% |

| Period of time assets were relevant property | 12 complete quarters (1 February 2021 to 1 March 2024) out of 40 |

| Tax due by trustees | (12/40) x 2.45% x £100,000 = £735 |

* Value of the trust fund at the last 10 yearly anniversary.

** Available NRB at the date of exit.

Exit charges can apply to all capital distributions from the trust, even where the scheme member died post age 75 and the capital payments are subject to the special income taxation rules described above.

Exit charges do not apply to the payment of natural income arising from the trust investments to a beneficiary.

Issued by a member of the Aberdeen Group, which comprises the Aberdeen Group plc and its subsidiaries.

Any links to websites, other than those belonging to the Aberdeen Group, are provided for general information purposes only. We accept no responsibility for the content of these websites, nor do we guarantee their availability.

Any reference to legislation and tax is based on Aberdeen's understanding of United Kingdom law and HM Revenue & Customs practice at the date of production. These may be subject to change in the future. Tax rates and reliefs may be altered. The value of tax reliefs to the investor depends on their financial circumstances. No guarantees are given regarding the effectiveness of any arrangements entered into on the basis of these comments.

This website describes products and services provided by subsidiaries of the Aberdeen Group.

Full product and service provider details are described on the legal information.

Aberdeen Group plc is registered in Scotland (SC286832) at 1 George Street, Edinburgh, EH2 2LL

Standard Life Savings Limited is registered in Scotland (SC180203) at 1 George Street, Edinburgh, EH2 2LL.

Standard Life Savings Limited is authorised and regulated by the Financial Conduct Authority.

© 2025 Aberdeen Group plc. All rights reserved.