Introductory guide to income tax

6 April 2024

Key points

- There are tax free allowances of up to £19,070 available across the different income types

- The personal allowance may be lost if income exceeds £100,000

- The order of how income is taxed may impact the availability of certain allowances

- Tax relief on pension contributions may extend the tax bands and could also help retain personal allowances and child benefit for higher earners

- The Scottish rates of income tax do not apply to savings and dividend income

Jump to the following sections of this guide:

What is income tax?

Income tax is a progressive tax system, the more you earn the higher the rate of income tax you will pay, with three different tax rates applying to bands of income. The slice of income which falls within each tax band is taxed at the rate for that band.

The bands for 2024/25 are:

- basic rate - taxable income up to £37,700

- higher rate - taxable income between £37,701 and £125,140

- additional rate - taxable income over £125,140

Scotland has a seven band system for the taxation of earned income. These additional bands do not apply to income from savings and investments which will follow the same three bands as the rest of the UK (see appendix for details for Scottish Taxpayers).

Income Tax is charged on a client’s total income from all sources in the tax year. This includes:

- employment income - salary, P11D benefits, self-employed profits and pension income

- rental income - rent from buy to lets or commercial property

- savings income - Interest from banks, building societies and certain investments

- dividend income - dividends received from shares and investments

- life assurance policy gains - chargeable gains made on investment bonds

The personal allowance

There is an amount of income which can be received each year before tax is payable. The Personal Allowance is currently £12,570 (2024/25).

However, it may be reduced if income is greater than £100,000. The allowance is reduced by £1 for every £2 of income over £100,000 so that those with income greater than £125,140 will lose their entire allowance.

John has adjusted net income of £110,000 the excess of £10,000 is reduced by £1 for £2 over £100,000 reducing his personal allowance by £5,000. John now has a Personal Allowance of £7,570.

Eligibility to the personal allowance is tested using adjusted net income. This is broadly total income before the application of reliefs such as top slicing relief, EIS and VCT tax relief but there are allowable deductions for individual pension contributions and gift aid.

This means the full chargeable gain on bond surrenders is added to other income in the tax year and could lead to the loss of the personal allowance if combined they exceed £100,000.

However, paying pension contributions or making charitable donations on which gift aid is claimed can help with the allowance being retained.

Lauren surrenders an onshore bond which she has held for 10 years and incurs a chargeable gain of £90,000. She has other income in the tax year of £35,140.

Her total income for the tax year is £125,140 and therefore she will lose all of her personal allowance.

However, if Lauren makes a pension contribution in the tax year of £25,140 (£20,112 net) this will bring her adjusted net income down to £100,000 and she will keep her personal allowance.

Marriage allowance

It's possible for some married couples (and civil partners) to transfer some of their unused personal allowance to their spouse.

Up to £1,260 of unused allowance can be transferred from a non-taxpaying spouse (income below £12,570), provided the spouse receiving the additional allowance does not pay income tax at higher than basic rate. This allows a maximum tax saving of £252 (£1,260 x 20%).

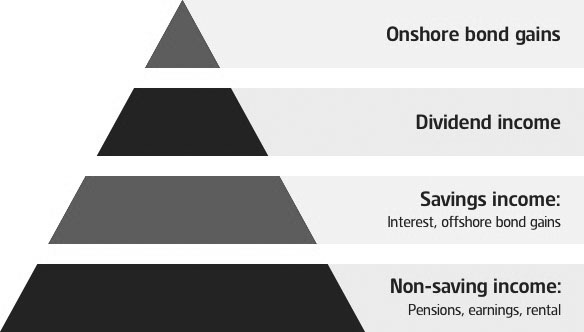

The order of taxing income

The order in which income is taxed is significant. Different sources of income may be taxed at different rates and the order in which they are taxed may determine the availability of certain tax free allowances.

The order in which income is taxed is:

Non-savings income

Non-savings income is first to be taxed through the bands in the order of taxation. This includes income from employment, self-employed profits, pension income, rental income and trust income.

The rates of tax for non-savings income in excess of the personal allowance are:

- basic rate 20%

- higher rate 40%

- additional rate 45%

Savings income

Savings income uses the same rates of tax as non-savings income (20%, 40% & 45%). However, there are additional tax free allowances for savings income.

The first £5,000 of savings income may be taxed at zero percent. This is known as the starting rate for savings and is in addition to the personal allowance and personal savings allowance. The £5,000 band reduces by £1 for every £1 of non-savings income over the personal allowane. So someone with just savings income could receive £18,570 (£12,570 + £5,000+ £1,000) without paying any tax.

But this additional tax free amount only applies if taxable non-savings income (i.e. income above the personal allowance) is less than £5,000.

The personal savings allowance is a further tax free allowance for basic and higher rate taxpayers. Basic rate taxpayers can receive £1,000 while higher rate taxpayers can receive £500. There is no allowance available to additional rate taxpayers.

Adjusted net income is used to determine whether the allowance is given at £1,000 or £500 and therefore individual pension contributions will reduce income for this purpose.

Susan has pension income of £15,000. She also receives £5,000 in interest from a portfolio of non-equity unit trusts.

| Non-savings income | Savings income | |

| Personal allowance | £12,570 x 0% | |

| Basic rate | £2,430 x 20% = £486 | |

| Starting rate for savings | £2,570 x 0% | |

| Personal savings allowance | £1,000 x 0% | |

| Basic rate | £1,430 x 20% =£286 | |

| Tax | £486 | £286 |

| Total tax | £486 + £286 = £772 | |

Dividend income

Dividend income has its own set of tax rates which are different from all other income. These are:

- 8.75% basic rate

- 33.75% higher rate

- 39.35% additional rate

There is also a Dividend Allowance of £500 (£1,000 2023/24). Unlike other income allowances everyone is entitled to the full allowance regardless of their income levels.

The first £500 of dividend income is taxed at zero percent and the allowance uses part of whichever tax band the income falls in.

Geraldine receives a salary of £42,500 plus a further £10,000 in dividends.

| Non-savings income | Dividend income | |

| Personal allowance | £12,570 x 0% | |

| Basic rate | (£42,500 - £12,570) £29,930 x 20% = £5,986 |

|

| Dividend allowance | £500 x 0% | |

| Basic rate | £7,270 x 8.75% =£636 | |

| Higher rate | £2,230 x 33.75% = £753 | |

| Tax | £5,986 | £636 + £753 = £1,389 |

| Total tax | £5,986 + £1,389 = £7,375 | |

The illustration below shows the rates and tax bands for each of the income types in 2024/25.

| Taxable income | Non-savings income |

Savings income |

Dividend income |

| £0 - £37,700 | 20% | 0% £0 - £5,000 |

0% £0 - £500 |

| 20% | 8.75% | ||

| £37,701 - £125,139 | 40% | 40% | 33.75% |

| Over £125,140 | 45% | 45% | 39.5% |

Life assurance policy gains

Investment bonds and other life assurance policies are subject to chargeable events legislation. Gains arising on these policies are subject to income tax. Where they sit in on the order of income will depend upon whether it is an onshore or offshore policy.

UK onshore policy gains are the top slice of all income and are taxed after dividend income. Proceeds are paid with a 20% non-reclaimable tax credit to account for the tax paid within the fund.

This will satisfy the liability for basic and non-taxpayers. Higher rate tax payers may have an additional 20% to pay and a further 25% for additional rate taxpayers.

Offshore policy gains are taxed as savings income. As a result gains which fall within personal allowance, starting rate for savings or personal savings allowance will be free of tax.

These investments pay no tax within the fund on income or gains and therefore policyholders do not receive a tax credit. So gains in excess of the available allowances will be taxed at the savings rates of 20%, 40% or 45%.

Both onshore and offshore policies may benefit from top slicing relief. This can reduce higher rate or additional rate tax on chargeable gains by allowing the policyholder to spread the investment gains over the number of years the bond has been held. Top slicing cannot be used to keep income within the tax free personal allowance and starting rate band.

Allocating the personal allowance

The personal allowance can be set against whichever income gives the best tax outcome. It doesn’t have to be applied against the natural order taxation. In most cases it would be the tax efficient option as dividend income is taxed last but at the lowest rate.

However, there may be some circumstances where allocating the personal allowance to dividends can give a better result. This may be the case where the starting rate for savings and the personal savings allowance are going unused as savings income is utilising the personal allowance.

Andrew has income from the following sources;

- £8,000 Pension income

- £6,000 Interest from savings

- £7,000 Dividends

| Non-savings | Savings | Dividends | |

| Personal allowance | £8,000 @ 0% | ||

| Starting rate for savings | £5,000 @ 0% | ||

| Personal savings allowance | £1,000 @ 0% | ||

| Personal allowance | £4,570 @ 0% | ||

| Dividend allowance | £500 @ 0% | ||

| Basic rate |

£1930 @ 8.75% = £169 | ||

| Total tax | £169 | ||

If the personal allowance had been allocated in the order of taxation in the example above, it would have meant a tax bill of £569 instead of £169. This is because savings income was covered by other available allowances (which, if not used, would have been wasted) resulting in the dividends bearing the tax. The first £500 would be tax free but the remaining £6,500 would have been taxed at 8.75% giving a tax bill of £569.

Tax reliefs

Tax reliefs are Government incentives to encourage certain investing and gifting.

Pension tax relief

Tax relief is given at the individual’s highest marginal rate on their pension contributions.

There are two ways in which pension tax relief may be given. These are often referred to as:

- net pay arrangements

- relief at source

Net pay arrangements are offered by certain workplace pensions, such as DB schemes. The pension contribution is deducted directly from payroll and before the deduction of tax. The amount of income subject to tax is therefore reduced and full tax relief is given directly into the pension at the highest marginal rate.

Relief at source is the method of relief used by personal pensions, including SIPPs and GPPs, as well as many occupational DC pensions. All contributions are paid net of basic rate tax (20%) and the pension provider adds the tax relief to the pension fund.

Higher rate and additional rate taxpayer can claim an additional 20% or 25% tax relief via their self-assessment. The additional tax relief is not paid directly into the pension but instead it reduces the tax paid on other income. This is achieved by extending the basic rate tax band by the amount of the gross pension contribution.

Jonathan has income of £80,000 a year. This tax year he makes a gross contribution of £10,000 to his SIPP. Jonathan writes a cheque for £8,000 to his SIPP provider and this is grossed up to £10,000 and added to his SIPP.

As a higher rate taxpayer Jonathan completes a tax return to claim his higher rate relief. The higher rate relief is given by extending his basic rate tax band so that less of his income is taxed at 40%.

| Personal allowance | £12,570 x 0% = 0 |

| Basic rate tax | £47,700 (£37,700 + £10,000) x 20% = £9,540 |

| Higher rate tax | £19,730 x 40% = £7,892 |

| Total tax | £17,432 |

Gift aid

Tax relief can be claimed on gifts to charity. This works in a similar way to pension contributions which get relief at source. If a gift aid declaration is completed the charity is able to claim basic rate relief on the amount they receive. Higher and additional rate taxpayers get their extra tax relief via self-assessment and the basic rate tax band is extended by the contribution.

EIS & VCT income tax relief

There is tax relief available to investors in Enterprise Investment Schemes (EIS) & Venture Capital Trusts (VCTs) to encourage investment in start-up companies. Relief acts as a tax reducer - the relief is knocked off the eventual tax bill rather than by adjustment of the tax bands.

Standalone tax charges

There are some tax charges which are subject to income tax but do not form part of the tax computation.

High income child benefit charge

From 6 April 2024 the threshold at which child benefit is withdrawn has increased from £50,000 to £60,000. For income between £60,000 and £80,000 the tax charge is now 1% for every full £200 of income over the £60,000 threshold. Child benefit is lost completley when adjusted net income exceeds £80,000..

The child benefit is reclaimed by imposing an income tax charge, the High Income Child Benefit Charge on the highest earner.

Jess and Dave are married. Jess has a salary of £66,000 . Dave earns £30,000. They have no other income. Jess claims the child benefit of £2,213 for their two children. As Jess has income in excess of £60,000 she will be subject to a tax charge of 1% of the child benefit claimed for every £200 of income over £60,000.

(£6,000/£200 x1%) x £2,213 = £664.

Despite the tax charge, they will still be better off by £1,549 if they continue to claim. As the charge uses adjusted net income the full child benefit could be retained if Jess makes a gross pension contribution of £6,000 (£4,800 net).

Up until 6 April 2024 child benefit was lost if either parent earned more than £50,000. For incomes between £50,000 and £60,000 the tax charge was 1% for every full £100 of income over the £50,000 threshold. Child benefit was lost completley when adjusted net income exceeded £60,000.

Pension tax charges

Exceeding the Annual Allowance (AA) may result in a tax charge. Although the charges are subject to income tax they do not form part of the tax computation and therefore do not have a knock on effect for other income.

Client’s paying more into their pension than their available annual allowance will be subject to the AA tax charge. The excess funding is added on top of all other income to determine the amount of tax which is payable. In some circumstances it may be possible for the charge to be paid from pension benefits.

Paying income tax

Some income will be paid with the appropriate amount of tax already deducted under the Pay As You Earn (PAYE) system. This will be the case for employees and anyone receiving pension income.

Self-assessment may be required for other sources of income where either no tax has been deducted or where additional tax may be due.

Dividend income and most savings income are now paid gross. Banks, Building Societies and Non-Equity Mutual Funds no longer pay interest with basic rate tax already deducted and dividends no longer have a notional 10% tax credit.

This means if income is covered by the available allowances there may be no need to make a reclaim. However, if savings income is greater than £10,000 in the tax year self-assessment still needs to be completed even if no tax is due.

The following will also trigger the need to complete a self-assessment tax return:

- rental income

- taxable income of more than £100,000

- claiming child benefit with income over £60,000

- overseas income

- pension contributions exceed the available annual allowance

The timescales for HMRC Self-Assessment and payment of tax are:

| 5 October | register for self-assessment (following the tax year end 5th April) |

| 31 October | paper returns |

| 31 January | online return |

| 31 January | first payment on account plus last year’s balancing payment |

| 31 July | second payment on account |

Each payment on account is half of last year’s tax bill, with the difference between the payments on account and the actual tax bill for the year made as balancing payment on the 31 January.

Scottish rate of income tax (SRIT)

Scottish resident taxpayers may pay a different amount of tax from the rest of the UK. For 2024/25 tax year the level at which higher rate tax applies is £43,663 compared to £50,270 in the rest of the UK. This band applies to non-savings income.

Savings and dividend income continues to be taxed at the UK rates and bands.

The impact for Scottish taxpayers is:

- some Scottish taxpayers may pay more tax on their non-savings income than taxpayers with the same income in UK

- Scottish taxpayers may need to use the Scottish bands and the UK bands to calculate their tax, for example if they have earned income and/or savings interest, dividends and capital gains.

HMRC continue to be responsible for collecting and administering the SRIT, so any queries about an individual taxpayer should be directed to them, rather than Revenue Scotland.

Personal allowance is £12,570 (assuming income in below £100,000) then non-savings & non-dividend income taxed in the following tax bands.

Bands for SRIT 2024/25

| Non-savings & non-dividend income | ||

| Band name | Taxable income (£) | Tax rate |

| Starter | 1 - 2,306 | 19% |

| Basic | 2,307 - 13,991 | 20% |

| Intermediate | 13,992 – 31,092 | 21% |

| Higher | 31,093 - 62,430 | 42% |

| Advanced rate | 62,431 - 125,140 | 45% |

| Top rate | Over 125,140 | 48% |

Capital Gains Tax basic rate band £37,700

Personal savings allowance basic rate band £37,700

What is SRIT payable on?

Individuals will pay the Scottish rate of income tax on:

- salary and self-employed earnings

- pensions

- rental income and income from REITs and PAIFs

- income received from discretionary trusts

The UK-wide threshold of £37,700 will apply for savings income, dividend income and capital gains received by Scottish taxpayers.

Pensions

Relief at source

The Scottish basic rate band will be extended by the gross amount of any pension contribution, where the taxpayer pays tax at a higher Scottish rate.

Annual allowance charge

Whether this is payable by the individual or the scheme, it will be calculated using the Scottish rates and bands if the individual is a Scottish taxpayer.

Gift Aid

Charities will continue to receive payments at the basic rate (20%) with Scottish taxpayers able to claim the correct amount of additional relief on top of this.

Issued by a member of the Aberdeen Group, which comprises the Aberdeen Group plc and its subsidiaries.

Any links to websites, other than those belonging to the Aberdeen Group, are provided for general information purposes only. We accept no responsibility for the content of these websites, nor do we guarantee their availability.

Any reference to legislation and tax is based on Aberdeen's understanding of United Kingdom law and HM Revenue & Customs practice at the date of production. These may be subject to change in the future. Tax rates and reliefs may be altered. The value of tax reliefs to the investor depends on their financial circumstances. No guarantees are given regarding the effectiveness of any arrangements entered into on the basis of these comments.

This website describes products and services provided by subsidiaries of the Aberdeen Group.

Full product and service provider details are described on the legal information.

Aberdeen Group plc is registered in Scotland (SC286832) at 1 George Street, Edinburgh, EH2 2LL

Standard Life Savings Limited is registered in Scotland (SC180203) at 1 George Street, Edinburgh, EH2 2LL.

Standard Life Savings Limited is authorised and regulated by the Financial Conduct Authority.

© 2025 Aberdeen Group plc. All rights reserved.

CII/PFS accredited CPDrelated modules

Related content

- How the proposed NI and dividend tax rises affect individuals, business owners and trustees

- Five funding tips for Pensions Awareness Day

- How would aligning CGT with income tax impact wrapper choice?

- Dividend changes pose new challenges for trustees

- What the self-employed basis period change means for pension funding