New State Pension

6 April 2024

Key points

- Applies to individuals reaching State Pension age on or after 6 April 2016

- A minimum of 10 ‘qualifying years’ of NICs or NI credits are needed to be eligible for any New State Pension

- For those already with an NI record before 6 April 2016, a starting ‘foundation amount' was calculated - the higher of entitlement calculated under both the old and new State Pension rules

- Any entitlement at 6 April 2016 over the full New State Pension is kept as a ‘protected payment’

- New State Pension entitlement is inflation-proofed by the 'triple lock'

- It's only possible to inherit New State Pension from a deceased spouse’s ‘protected payment’

Jump to the following sections of this guide:

Eligibility for the New State Pension

The New State Pension will apply to anyone who:

- reaches State Pension age on or after 6 April 2016 - this means:

- men born after 5 April 1951

- women born after 5 April 1953

and

- has at least 10 'qualifying years' of National Insurance contributions (NICs) or NI credits. This is a big increase from the old minimum of just one qualifying year to get some Basic State Pension.

But, in some circumstances, an individual may be eligible for New State Pension based on their spouse or civil partner's NI record.

Anyone who reached State Pension age before 6 April 2016 will continue to receive their State Pension in line with the old rules.

State Pension age

This is the earliest age that State Pensions can be taken. Due to increases in life expectancy and the need to make the cost of providing State Pensions sustainable, the Government is increasing State Pension age (SPA).

Since October 2020, the SPA has been age 66, for both for men and women, having steadily increased from age 65 over the previous two years.

Further planned SPA increases:

- A further increase to 67 will be phased in between April 2026 and April 2028.

- An increase to 68 is due to be phased in between 2044 and 2046.

However, the Government has, on more than one occasion, indicated that this could be brought forward. A review in July 2017 suggested it could be phased in between 2037 and 2039. However, a review in March 2023 stated that a decision on whether to bring forward the increase to 68 will be deferred until after the next general election.

The Pensions Act 2014 provides for a regular review of the State Pension age - at least once every five years.

Checking an individual's SPA:

- GOV.UK has a very easy to use State Pension age calculator.

- Alternatively, it also has State Pension age timetables.

Calculating an individual's New State Pension

The full rate of New State Pension is £221.20 a week for tax year 2024/25.

To get the full weekly rate of New State Pension, an individual with no NI record before 6 April 2016 will need 35 qualifying years of NICs or NI credits. This is five qualifying years more than what was required to get the full Basic State Pension under the old rules.

There's also a minimum. To get any New State Pension at all, you'll need at least 10 qualifying years.

Anyone with between 10 and 35 qualifying years will get a proportionate amount of New State Pension.

It's possible to top up the New State Pension, by paying Class 2 or Class 3 NICs. Voluntary contributions can usually be paid to fill any gaps in the past six tax years. Up until 5 April 2025, those reaching SPA after 5 April 2016 also have the opportunity to pay voluntary contributions for any gaps between April 2006 and April 2016.

Those who started their working life before 6 April 2016 are likely to have built up some State Pension entitlement already - this is protected. A calculation is done, as at 6 April 2016, to establish a New State Pension starting amount, the ‘foundation amount', on which their New State Pension entitlement can possibly be built.

Foundation amount

To establish an individual's foundation amount, a comparison is made between:

- what they had built up under the old rules (as if reaching State Pension age in April 2016) and

- what they'd get if the New State Pension rules had started at the beginning of their working life

The foundation amount is the higher of the two figures.

Periods of being contracted-out

When working out the foundation amount, a deduction is made to reflect that lower NICs were paid/rebates were received during any periods of being contracted-out of SERPS or S2P.

If the foundation amount is below £155.65 a week (the full New State Pension as at 6 April 2016) additional entitlement will be built up for any further qualifying years, at a rate of £6.32 a week (in today’s terms) for each qualifying year (i.e. £221.20/35) up to a maximum of the full New State Pension. Those who are due to get less than the maximum may be able to top it up by paying voluntary NICs to fill gaps in their NI record.

If the foundation amount is over £155.65 a week, the individual will get the full New State Pension plus a 'protected payment' (which represents the amount in excess of the full New State Pension). There will be no scope to build up any more New State Pension.

This could, for example, be an older employee with a lot of years contracted out or a younger employee who had accrued a reasonable amount of Additional State Pension.

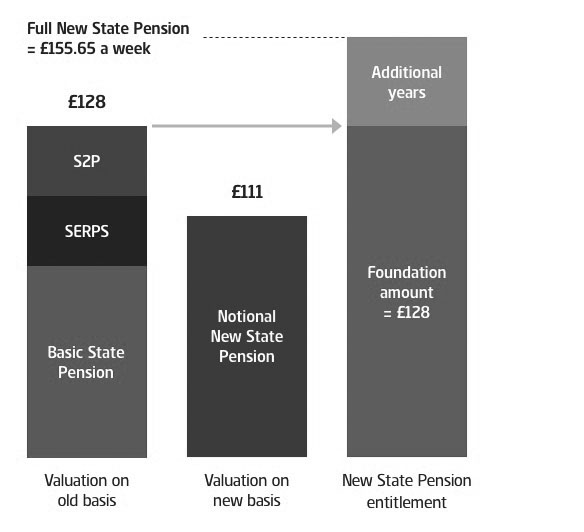

- The valuation on the old basis (£128 a week) became the foundation amount.

- As this was below the amount of the full New State Pension, there's scope to build additional entitlement for any further qualifying years.

This could, for example, be someone who had periods of self-employment (so not accruing Additional State Pension for those periods) or someone who would get more NI credits under the New State Pension valuation basis.

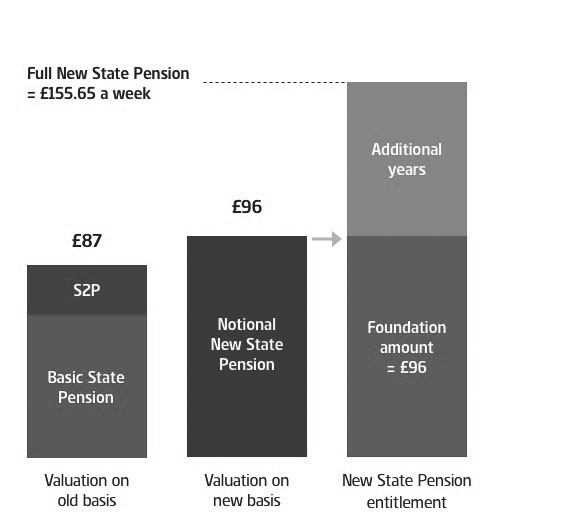

- The valuation on the new basis (£96 a week) became the foundation amount.

- Again, as this was below the amount of the full New State Pension, there's scope to build additional entitlement for any further qualifying years.

This is likely to be an older employee with lots of qualifying years, who had long periods of being contracted in.

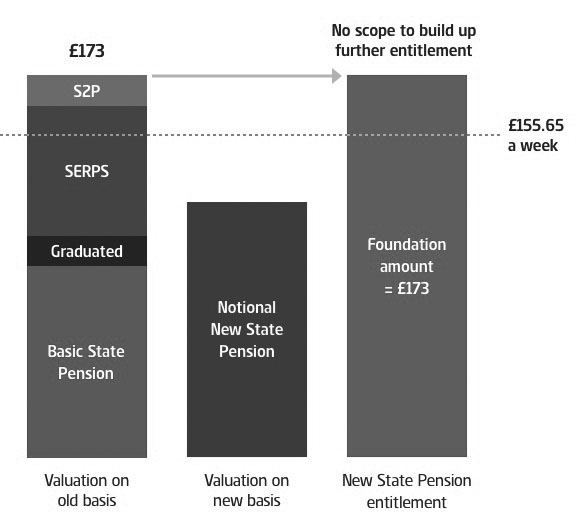

- The valuation on the old basis (£173 a week) became the foundation amount.

- As this was higher than the full New State Pension, the individual will get the full New State Pension plus a ‘protected payment' (£17.35 a week, as at April 2016).

- But there's no scope to build additional entitlement, even though NICs may continue.

Getting an estimate of New State Pension entitlement

Of course, the above calculations can be complex. Fortunately, you can request a forecast:

- online from GOV.UK

- by calling the Future Pension Centre on 0800 731 0175 or

- if at least 30 days from State Pension age, using form BR19

The forecast will tell you what you've accrued to date and also what you can expect (in today's terms) at State Pension age if your NICs (or credits) continue.

State Pension increases

The New State Pension will be increased each April in line by the highest of:

- the average percentage increase in UK earnings

- the percentage increase in the cost of living (CPI over the 12 months ending in the previous September) and

- 2.5%

This is the so-called 'triple lock' guarantee. For tax year 2022/23, the earnings element of the triple lock was suspended, following distortions to the earnings statistics as a result of the COVID-19 pandemic.

However, any additional ‘protected payment' will be revalued and uprated in line with the increase in CPI since April 2016. The increase from April 2016 to April 2024 is 31.7%.

Living overseas

Currently, individuals who move overseas will only get UK State pension increases each year if they live in either:

- the European Economic Area (EEA), Gibraltar or Switzerland

- a country that has a social security agreement with the UK that allows for cost of living increases to the State Pension – see GOV.UK for details

This position continues post Brexit.

Definition of a ‘qualifying year’

The definition of a qualifying year depends on the period involved:

- Pre April 1975 - the total number of National Insurance contributions paid (or credited) is divided by 50 to give the number of qualifying years in that period.

- April 1975 to April 1978 - a qualifying year is a tax year in which a person received (or was treated as having received) earnings of at least 50 times the weekly lower earnings limit for the year.

- From April 1978 - a qualifying year is a tax year in which a person received (or was treated as having received) earnings of at least 52 times the weekly lower earnings limit for the year.

Time spent working overseas

While the amount of UK State pension an individual receives is always based on their UK NI record, it may be possible to use time abroad to help make up the minimum number of qualifying years required to be eligible for the State Pension. This can apply to those who have lived or worked in either:

- the European Economic Area (EEA), Gibraltar or Switzerland

- certain other countries that have a social security agreement with the UK.

Again, this position continues post Brexit.

However, he worked in Germany for seven years and paid contributions towards the German State Pension. So the combination means he is eligible for the new State Pension. But his UK pension will still just be based on the six qualifying years on his UK NI record.

Deferring the New State Pension

It is an option to not take the State Pension at State Pension age - it can be deferred and taken as an increased weekly pension.

If the claim is deferred for at least nine weeks, the original pension due at State Pension age will be increased by 1% for every nine weeks deferred - equivalent to an increase of around 5.8% for each full year deferred.

But there's no longer an option to take deferred State Pension payments as a lump sum.

Also, if someone reached State Pension age before 6 April 2016 but has deferred their State Pension beyond that date, they'll still receive their State Pension under the old rules - they won't become eligible for the New State Pension.

State Pension already in payment

If someone is already getting their State Pension, they can still take advantage of the deferral options by electing to give up their pension for a period. But this can only be done once.

Taxation of New State Pension

Although State Pension is a taxable benefit, tax is never deducted from it. Instead, the amount paid is added to any other income and if the total is more than the individual's personal tax allowance, the tax is normally deducted from the other income.

- Receiving another pension - HMRC will adjust the individual's tax code so that the tax paid includes the amount due on their State Pension. The pension income is taxed through the PAYE (Pay As You Earn) scheme.

- Only getting State Pension - the way tax is paid on the individual's State Pension depends on whether they're employed or not:

- Employed - the individual's tax code is adjusted and tax is paid through the employer's PAYE scheme.

- Not employed - the individual needs to pay any tax due through self-assessment by completing a tax return.

For clarity, the Scottish tax bands and rates apply when calculating the tax due on State Pension income or lump sums for Scottish residents.

Claiming the New State Pension

Eligible individuals will be automatically sent a letter no later than two months before they reach State Pension age (SPA) which tells them what to do.

To get State Pension, an individual must claim it. If within four months of reaching State Pension age, a claim can be made either:

- online at GOV.UK or

- by calling the Pension Service on 0800 731 7898 to request a State Pension claim form to be sent in the post.

The claims process is different for those living overseas. State Pension can be claimed by either:

- sending a completed international claim form (IPC BR1 NSP) to the International Pension Centre or

- calling the International Pension Centre on 0191 218 7777.

The claim will cover the New State Pension and any ‘protected payment'.

Inheriting New State Pension entitlement

The New State Pension has been designed to ensure that, in the long term, the majority of people will be able to get the full New State Pension in their own right. So, eventually, it will purely be based on an individual's own record of NICs and NI credits.

But, under the old system, it was sometimes possible for a widow, widower or former civil partner to inherit some State Pension or for someone to get some State Pension derived from the NI record of their current or former spouse or civil partner. As some individuals may be expecting or even relying on getting this - for example, women who elected to pay reduced rate NICs - transitional rules have been put in place.

Information on inheriting or increasing State Pension from a spouse or civil partner is available on GOV.UK.

Issued by a member of the Aberdeen Group, which comprises the Aberdeen Group plc and its subsidiaries.

Any links to websites, other than those belonging to the Aberdeen Group, are provided for general information purposes only. We accept no responsibility for the content of these websites, nor do we guarantee their availability.

Any reference to legislation and tax is based on Aberdeen's understanding of United Kingdom law and HM Revenue & Customs practice at the date of production. These may be subject to change in the future. Tax rates and reliefs may be altered. The value of tax reliefs to the investor depends on their financial circumstances. No guarantees are given regarding the effectiveness of any arrangements entered into on the basis of these comments.

This website describes products and services provided by subsidiaries of the Aberdeen Group.

Full product and service provider details are described on the legal information.

Aberdeen Group plc is registered in Scotland (SC286832) at 1 George Street, Edinburgh, EH2 2LL

Standard Life Savings Limited is registered in Scotland (SC180203) at 1 George Street, Edinburgh, EH2 2LL.

Standard Life Savings Limited is authorised and regulated by the Financial Conduct Authority.

© 2025 Aberdeen Group plc. All rights reserved.